when is capital gains tax increasing

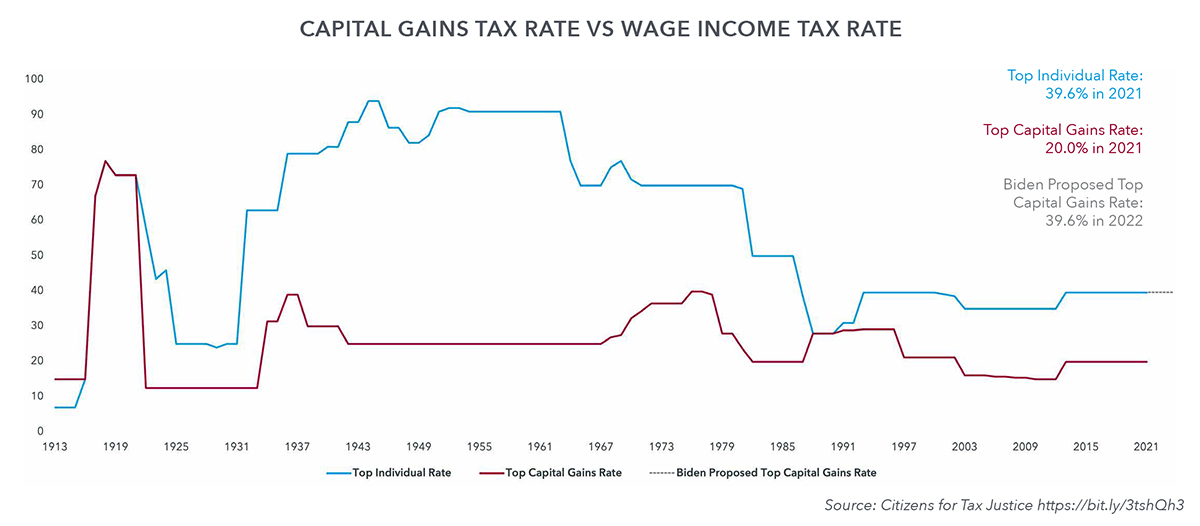

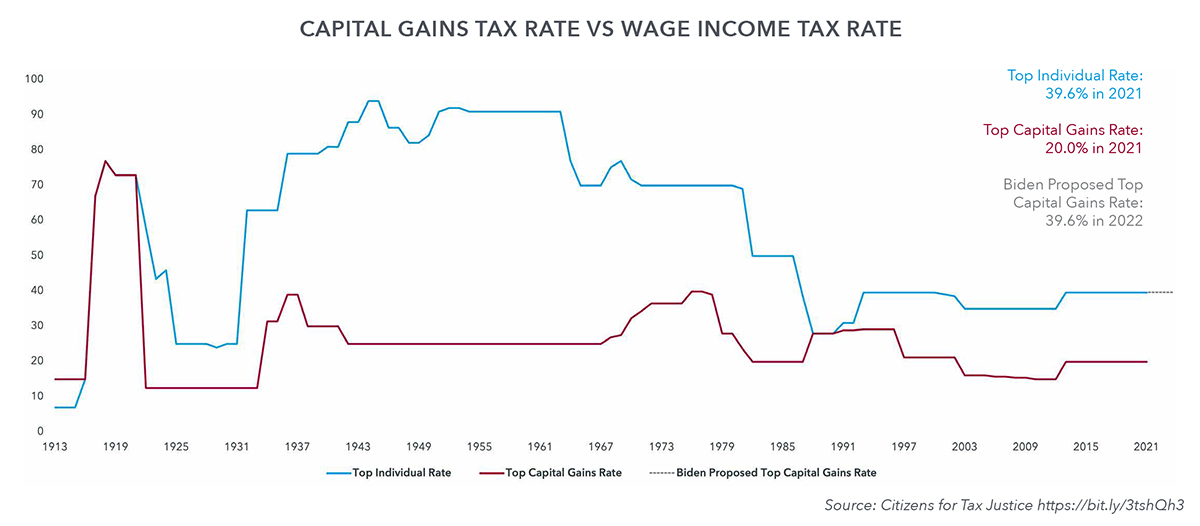

The IRS has increased the taxable income thresholds for the 0 15 and 20 long-term capital gains brackets for 2023. From 1954 to 1967 the maximum capital gains tax rate was 25.

Capital Gains Tax In The United States Wikipedia

If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0.

. April 23 2021 Garrett Watson Erica York President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and. Not only would President Bidens plan increase the capital gains tax. The Finance Act of 2022 Finance Act has amended the Income Tax Act ITA by increasing the rate of capital gains tax CGT from 5.

More by this Author. Understanding Capital Gains and the Biden Tax Plan. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or.

Yet for those with capital gains in lower income. The two biggest tax-cutting Conservative Chancellors in British history both increased capital gains tax and for good. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million.

The capital gains tax on most net gains is no more than 15 for most people. By ALEX KANYI. In 1978 Congress eliminated.

To summarize many of the OTS proposals did not pass however we can see there are some increases in tax for capital gains. In 2021 the higher 288 long-term capital gains rate will be applied 3 to single taxpayers whose adjusted gross income exceeds 523601 and 628301 for taxpayers filing married filing. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Heres what investors need to know. Long-Term Capital Gains Taxes.

Increasing the federal capital gains rate to 434 for taxpayers with adjusted gross income over 1 million. 14 October 2022. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28.

Rocky Mengle Senior Tax Editor.

Capital Gains Tax Hike And More May Come Just After Labor Day

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

Capital Gains Revenue In The Budget

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Strategies To Deal With Potential Capital Gains Tax Increases Kiplinger

Sweeping Reform Would Tax Capital Gains Like Ordinary Income Itep

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Increase In Capital Gains Taxes Will Affect Your Business In Many Ways Fuoco Group

Managing Tax Rate Uncertainty Russell Investments

How Could Changing Capital Gains Taxes Raise More Revenue

Biden S Fy2023 Budget Proposal Real Estate And Corporate Tax Increases In 2022 Windes

Effects Of Changing Tax Policy On Commercial Real Estate

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center

Biden S Capital Gains Tax Increase Is More Unproductive Misdirection The Hill

Measure Seeks To End Capital Gains Tax On Inflation Financial Regulation News

Increasing The Capital Gains Tax Penalizing Initiative Enterprise And Not Just The Rich